Health Insurance Company Surpluses

INSIDE THE ISSUE

> Health Insurer Surpluses

> Post-Acute Care Guide Translations

> A Call for Telehealth Parity

> Operating Margins

> Another Cost to Hospitals

> Will the Health Emergency Continue?

MONDAY REPORT

Assessing Health Insurance Company Surpluses

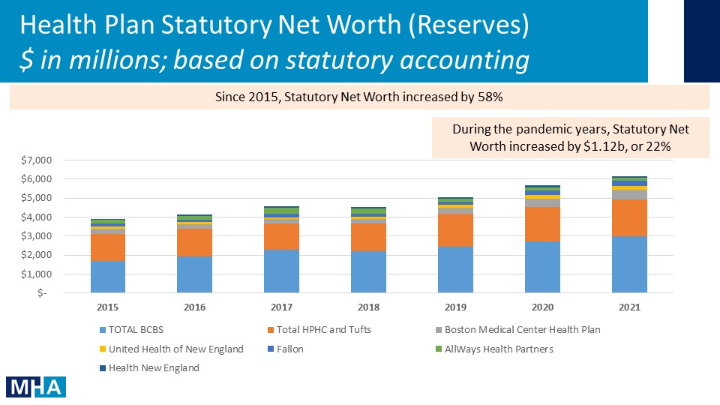

In the coming weeks, MHA will publish its Semi-Annual Health Plan Performance Report, which will focus on calendar year 2021 health insurance company financials and enrollment in Massachusetts. An early look shows continued growth in health insurer net income and statutory net worth during the COVID-19 public health emergency.

Health insurers have played an important role during the pandemic, providing coverage of medical care, new therapies, vaccinations, and COVID-19 testing. As required by federal law, insurers also provided rebates to premium payers as healthcare utilization plummeted as result of social distancing and pauses in elective procedures. Beyond state and federal requirements, some insurers independently deployed financial support and capital to stabilize providers and leveraged their resources and community relationships to support the outbreak response.

Despite these new expenses and efforts related to the COVID-19 emergency, health insurance company profits were substantially higher than at any point in recent history given the overwhelming effect of decreased medical utilization. Aggregate net income across Massachusetts health plans was $637 million in 2020 and $467 million in 2021, a $1.2 billion profit during the pandemic years – exceeding the previous five years combined. These gains have helped to fuel a 22% increase in health insurance company net worth during the pandemic, which now totals $6.1 billion across all plans.

Statutory Net Worth Surplus is the excess of an insurer’s assets compared to its liabilities using statutory accounting rules; Numbers aren’t shown for health plans with less than $500m net worth.

All insurance companies must carry “reserves” to cover current and expected claims and other liabilities. The insurers also have “surpluses” that are the insurers’ excess assets over those liabilities, referred to as net worth. One of the main reasons for carrying a surplus is to ensure a health insurer remains solvent and has funds to meet its obligations when certain unexpected events occur. However, the greatest health threat in generations – the COVID-19 pandemic — did not cause a catastrophic increase in claims payouts. In fact, for much of the pandemic the opposite was true, resulting in record health insurer gains.

Regulators such as the Division of Insurance in Massachusetts, use a risk-based capital (RBC) ratio to gauge if an insurer can fulfill its financial obligations. A health plan may be subject to DOI intervention whenever its RBC ratio falls below the company action level of 200%. In Massachusetts, according to the most recent data filed with the National Association of Insurance Commissioners, the amount of surplus exceeding 500% RBC equates to approximately $1.25 billion. Four health insurance companies – Harvard Pilgrim Health Care, United Health of New England, Tufts Associated HMO, and HMO Blue – have risk-based capital ratios closely approaching or exceeding 600%. (Tufts and Harvard Pilgrim are now part of Point32Health.)

MHA’s Semi-Annual Health Plan Performance Report for 2021 is expected to be released in June 2022.

MHA’s Post-Acute Care Guide Translated into Five Languages

As part of its efforts to improve health equity and recognize the diverse patient populations in Massachusetts, MHA has translated its After the Hospital: A Guide to Post-Acute Care into five languages used most prominently in the state: Mandarin and Cantonese Chinese, Haitian Creole, Portuguese, and Spanish. The guide was created through MHA’s Continuum of Care Council, which is made up of leaders from acute care hospitals; long-term acute care hospitals; inpatient rehabilitation facilities; skilled nursing facilities; the home care, hospice, and palliative care communities; and assisted living facilities.

After the Hospital: A Guide to Post-Acute Care fulfills a long-standing need to educate the public and members of the healthcare community about the care options available to patients following a medical event or hospitalization. The English language guide and translated versions are available for download through PatientCareLink, as are accompanying 1-pagers, posters, and postcards.

Post-acute care – provided outside of the traditional hospital setting – may include rehabilitation; physical, speech or occupational therapy; comfort care that focuses on providing relief from pain and other symptoms of a serious illness; home care; or end-of-life care. Puzzling through the various options and choosing the right one has presented difficulties to patients – and often clinicians as well.

The guide cuts through the confusion to provide patients, their families, or the person entrusted with their care a roadmap that will assist them in understanding their care needs, learning about services that meet their needs, talking to their health insurance company, finding out more about their providers, and making the choice that is right for them.

Senate Amendments Include Call for Telehealth Parity

The State Senate begins debate tomorrow on the $49.7 billion budget proposal that the Senate’s Ways & Means Committee released on May 10. Senators sponsored seven MHA priority amendments to the budget that reflect the healthcare community’s interest in strengthening the behavioral healthcare system, health equity, and fair reimbursement, among other issues.

For example, Amendment #448, filed by Senator John Velis (D-Holyoke), would require the commonwealth to fully fund the Health Safety Net at the statutorily required amount of $30 million. Amendment #481, filed by Senator Joan Lovely (D-Salem), would require commercial health plans, MassHealth, and Group Insurance Commission health plans to provide reimbursement for each day that a patient boards in an emergency department, on a medical surgical floor, or in an observation unit for behavioral health admission. Amendment #544, filed by Senator John Cronin (D-Leominster), would establish a digital navigator program within the Department of Public Health to support community health workers and other healthcare professionals in offering digital literacy training for disenfranchised patient populations who struggle accessing telehealth care.

Another telehealth amendment, #828 filed by Senator Barry Finegold (D-Andover), would extend telehealth reimbursement parity for primary care and chronic disease management services for two years beyond the date that the Division of Insurance (DOI) issues final regulations required under the state’s telehealth law.

Last week, MHA and the tMED Coalition, of which MHA is a founding member, sent comments to DOI on those proposed telehealth regulations. One of the major concerns of the provider community is that the proposed rules governing telehealth rely on a Medicare definition to outline which chronic conditions can be covered. The conditions therefore do not include ones commonly found in the under-age-65 or pediatric population. MHA and tMED are also concerned that the proposed regulations narrowly define who is able to be reimbursed for behavioral health services. Because behavioral healthcare is tied closely to primary care and community-based services, the new telehealth rules must reflect that, MHA and tMed wrote.

“Any effort to create an exclusive list of qualified providers limited to those licensed mental health professionals included [in state law] is not consistent with who actually provides behavioral health services in clinical practice and would negate the clear legislative intent,” the groups wrote. “This action would undermine the ability of many professionals, particularly those treating children and patients with developmental disabilities, to provide covered telehealth services. Behavioral health services that are integrated or embedded in primary care and community-based services should be reimbursed on par with in-person visits – regardless of how the services are billed by the patient’s insurance benefit.”

A Look at Operating Margins

The Center for Health Information and Analysis (CHIA) last Thursday released its latest (Fiscal Year 2021) report on hospital financials that showed median operating margins at just 1.2% — a decrease of 0.1% from FY2020. The 11 community hospitals reporting to CHIA reported a 0.6% operating margin.

Operating margins show “real” money on hand to pay real day-to-day bills. When rating agencies assess a hospital’s financial strength to determine its ability to borrow money, the agency looks at the facility’s operating margin.

“2021 was a devastating year for the stability of the healthcare system, with providers spending every dollar needed to continue serving their communities, even as they incurred tremendous losses during rollbacks of planned procedures and other non-emergent care services,” said Dan McHale, MHA’s vice president, Healthcare Finance & Policy. “The latest Omicron wave – which occurred after the period reflected in CHIA’s report – was the most difficult stretch yet, with Massachusetts hospitals losing more than $430 million in the first two months of 2022 alone. In January, the statewide median operating margins had dropped to negative 10 percent.

“MHA and our members are grateful for the relief funding devoted to date, which has allowed our hospitals to weather the storm and keep their doors open. We will continue to rely on the support of our public officials as healthcare providers continue to absorb these new economic realities – including those related to the pandemic response and the healthcare workforce.”

The Expenses Associated with Platelet Contamination Mitigation

In addition to the shortage of blood that has plagued the nation throughout the pandemic, a new blood concern is worrying hospitals – the cost of protecting against bacterial contamination in platelets.

As this letter signed by 13 Members of Congress explains, the Food and Drug Administration (FDA) issued guidance about the need to protect the platelet supply and the three proposed market solutions for preventing bacterial contamination of the blood product. The concern is that the largest supplier of blood, the American Red Cross, has chosen the most expensive method, thereby further driving up the cost of platelets by as much as $150 per unit – a cost that will be passed on to hospitals. This article from Kaiser Health News explains the issue fully. In addition to pharmaceutical prices, blood product costs are generally beyond a hospital’s ability to control.

PHE Extension Looks Likely and CMS Begins Monthly Unwinding Calls

In December, U.S. Department of Health and Human Services Secretary Xavier Becerra pledged to provide a 60-day notice of the end of the Public Health Emergency (PHE), which is currently scheduled to end on July 15. The 60-day threshold passed on Monday, May 16, appearing to signal that an extension beyond July 15 will occur. While the Secretary is not required to extend the PHE for a full 90 days, if it is extended fully the next deadline would fall in mid-October.

Federal focus on the PHE unwinding process continues and last week the Centers for Medicare and Medicaid Services (CMS) announced a series of monthly calls for healthcare stakeholders. In the CMS e-mail invitation, the agency notes the flexibilities put in place to protect coverage during the pandemic, adding that “at some point soon states will be required to restart Medicaid and CHIP eligibility reviews meaning that millions of people could lose their health coverage due to procedural reasons. HHS and CMS are working to ensure that people are connected to the best coverage they are eligible for and would like to partner with YOU.” To register for the monthly CMS PHE unwinding calls, click here.

Massachusetts Health & Hospital Association

Massachusetts Health & Hospital Association