PLEASE NOTE: MHA has upgraded its Member Portal. Click here to gain access.

Hospital Relief, Continuing Resolution, and more …

INSIDE THE ISSUE

> Hospital Funding Relief

> Continuing Resolution

> Medicare PAYGO Cuts?

> Unilateral Insurer Actions

> MOUD Coverage

> Hospital at Home Report

> Violence Prevention

MONDAY REPORT

Legislature Responds to Funding Crisis

Following months of productive dialogue around the worsening state of hospital finances, the Massachusetts House and Senate last week passed a hospital funding bill that transfers $77 million into the Health Safety Net fund and provides $122 million to high public payer hospitals, mainly through a tiered system that takes into account a hospital’s payer mix, state relative price, and operating margins. The bill also provides $35 million to community health centers. The bill now awaits Governor Maura Healey’s signature.

Both the Health Safety Net funding and much of the supplemental payments to hospitals are eligible for federal matching funds. As such, the FY25 RFA – the main Medicaid contract between the state and the federal government – will need to be amended and approved by the Centers for Medicare & Medicaid Services before September 30.

The $199 million relief package from the state and the federal match are the result of a months-long advocacy effort from the hospital community that not only is facing funding shortfalls this fiscal year but is bracing for an increase in the rate of uninsured people in the state along with decreased federal funding in coming years.

As the bill was sent to the governor’s desk, MHA President & CEO Steve Walsh credited the work of Healey as well as House Speaker Ron Mariano, Senate President Karen Spilka, Ways & Means Chairs Rep. Aaron Michlewitz and Sen. Michael Rodrigues, and Health Care Financing Chairs Rep. John Lawn and Sen. Cindy Friedman.

“This investment comes at a time of extraordinary distress for our hospitals and health systems, and with the effects of new federal policies now on the horizon, policymakers are stepping up to ensure providers have the resources they need to carry on their mission and deliver accessible care for the commonwealth’s seven million patients,” Walsh said. “We look forward to working with the legislature, Governor Healey, [Executive Office of Health & Human Services] Secretary [Kiame] Mahaniah, and Assistant Secretary [Mike] Levine on long-term solutions to our commonwealth’s safety net challenge. But this week’s proposal is an immediate step and an extraordinary response from state leaders on behalf of local healthcare organizations and their patients.”

The Massachusetts Taxpayers Foundation reports that, moving forward, the One Big Beautiful Bill could more than double the number of uninsured people in Massachusetts and increase the Safety Net’s demand by up to $510 million.

U.S. House Advances Spending Bill; Democrats Propose Alternative

Last Friday, the U.S. House of Representatives, facing a government shutdown on October 1, passed a Republican-drafted continuing resolution (CR) to fund the government through November 21. The bill then moved to the Senate on Friday where initial votes failed to achieve the 60-vote threshold for passage.

The House bill was crafted without Democratic input and passed narrowly 217-212, with two Republicans (Kentucky’s Thomas Massie and Indiana’s Victoria Spartz) voting no and one Democrat (Maine’s Jared Golden) voting yes.

The seven-week funding proposal temporarily extends several expiring healthcare provisions, such as Medicare telehealth flexibilities, but does not extend the Affordable Care Act’s enhanced premium tax credits that were created in 2021 during the COVID-19 pandemic. In 2022, with passage of the Inflation Reduction Act, those credits were extended though the end of this year, 2025.

The extensions, in addition to telehealth flexibilities, receiving bipartisan support are:

- A moratorium on scheduled Medicaid Disproportionate Share Hospital cuts; without this moratorium, Massachusetts would lose 85.7% of its Medicaid DSH allotment, or $786.3 million cut, according to the Medicaid and CHIP Payment and Access Commission (MACPAC).

- Medicare Acute Hospital Care at Home waivers.

- Medicare Low-Volume Hospital adjustment and Medicare-Dependent Hospital program.

- Community Health Centers, National Health Service Corps, Special Diabetes, and Teaching Health Center Graduate Medical Education programs.

Congressional Democrats reacted strongly against the GOP proposal and released their own alternative that extends federal funding through October 31, extends the expiring health programs included in the GOP proposal, but also would makes permanent the enhanced premium tax credits. The Democratic proposal also includes a repeal of some Medicaid and ACA provisions in HR 1, or the One Big Beautiful Bill.

Senate Minority Leader Chuck Schumer (D-N.Y.) joined with House Minority Leader Hakeem Jeffries (D-N.Y.) to denounce the GOP stopgap measure, saying, it “fails to meet the needs of the American people and does nothing to stop the looming healthcare crisis.”

The Senate’s failure on Friday to pass a measure means the threat of a shutdown has increased significantly, although a renewed effort at a resolution will no doubt resume when the Senate returns on September 29.

Beyond FY26 Funding, Potential Massive Medicare Cuts Loom

In the short term, Congress’ health focus is on the federal funding decisions for FY2026 and expiring health programs such as the ACA’s enhanced premium tax credits and telehealth flexibilities. But as the end of the year nears, Congress will also need to address the statutory “pay-as-you-go” or “PAYGO” sequester and the possibility of new Medicare cuts.

Without congressional action before the end of year, statutory PAYGO requires an across-the-board sequester cut of all discretionary programs from 2026-2034 (with some exceptions), including a Medicare cut capped at 4%. This would be in addition to the current 2% sequester cut that began in 2022 and remains in effect through FY2031. The statutory PAYGO is triggered whenever Congress passes legislation that the Congressional Budget Office deems will increase the deficit by more than $2.3 trillion, as is the case with the One Big Beautiful Bill. While there appears to be bipartisan support for preventing statutory PAYGO from being implemented next year, no action has yet been taken on how to forestall the cuts.

Insurers Take Unilateral Moves to Stem Their Losses

Commercial health insurance companies, just like hospitals and health systems, took a financial hit in 2024 and those losses are continuing through 2025. But while providers remain locked into payment contracts with commercial and public payers, the insurers are responding to their losses by undertaking a series of unilateral moves that may be good for their financial health in the short term, but are amplifying the financial pain and administrative burden for providers.

The insurer policies have come one after the other through the summer and fall and involve not only the large national plans, but some local players as well.

Aetna, for example, recently announced that effective November 15, it will institute a “Level of Severity Inpatient Payment Policy” that automatically reduces payment for inpatient stays unless they meet Aetna’s supplemental guidelines for inpatient admissions, regardless of whether they meet the CMS Two-Midnight Rule. (The Two-Midnight rule essentially means if the admitting physician expects a patient to stay across two midnights, then Medicare pays the higher Part A inpatient rate as opposed to the lower Part B “observation-level” rate.) If Aetna deems these stays do not meet its new, arbitrarily imposed policy, then it reimburses them at a lower rate, even when the admission is medically necessary and appropriate under CMS standards. And Aetna’s announced policy even fails to include a formal denial process, making it difficult for hospitals to identify admissions paid at the lower rate and thereby circumventing appeal rights guaranteed under federal law. MHA wrote this letter calling on CMS to request that Aetna withdraw the policy.

Or take Cigna, which announced that effective October 1, it will begin automatically “downcoding” the billing level for certain office visits based on the information contained on the claim form, as opposed to the information in the medical record. The insurer will run specific evaluation and management (E&M) codes that it says are often misused and adjust them down by one level if certain guidelines are not met. Physicians who want to challenge the decisions must review each downcoding and then submit supporting medical records – by fax. This month, U.S. Senator Richard Blumenthal (D-Conn.) criticized the Cigna policy, saying it would “significantly increase administrative burdens and costs for physicians while jeopardizing patient care.”

Last week, MHA and the Mass Medical Society co-signed a letter to Blue Cross Blue Shield of Massachusetts (BCBSMA) expressing their “significant concern” about the insurer’s plan, effective November 3, to undertake the same downcoding on the same E&M codes as Cigna.

BCBSMA has contracted with Cotiviti to process the claims using a “proprietary algorithm” and to downcode them without first reviewing the underlying clinical documentation. MHA and MMS expressed concern with the fact that providers have little idea what in the claims will trigger a downcode, or who at Cotiviti (not BCBSMA) will review providers’ appeals of the downcodes.

“Although ostensibly designed to ensure coding accuracy, the true purpose of the policy appears to be cost control,” MHA and MMS wrote. “However, by introducing a routinized down-coding algorithm, the policy may have the opposite effect. This policy could disincentivize providers from delivering complex care to the patients who need it most. While it may result in short-term savings for the insurer, it could ultimately lead to worse healthcare outcomes and higher long-term costs.”

MHA has also issued a complaint to the Division of Insurance about a unilateral policy that Point32Health instituted earlier this year. Under the policy, Point32’s plans (Harvard Pilgrim Health Care, Tufts Health Plan Commercial, and Tufts Health Direct) will evaluate any request for a short inpatient stay of up to 48 hours to determine if it is more appropriate to categorize the encounter as an observation stay. Any inpatient notification determined to be consistent with an observation stay as a result of the administrative review will be denied. Because Point32Health has determined that its policy is considered an administrative or technical denial, it will not be subject to peer-to-peer review.

In a letter to DOI in August, MHA wrote, “Since the policy was implemented on January 1, 2025, Massachusetts hospitals continue to have services denied inappropriately or downgraded without the opportunity to contest the denial through a peer-to-peer review process. MHA seeks to find an immediate resolution to this issue on behalf of our member hospitals as we believe Point32 is not in compliance with Massachusetts regulations or with its own policies.”

MHA to Insurers: Don’t Just Cover MOUD, Reimburse Too

It would seem like a common-sense idea: a provider dispenses lifesaving Naloxone (“Narcan”) or buprenorphine to a patient to treat that patient’s opioid use disorder, and then the provider gets reimbursed for the medication. But that’s not what is now occurring across Massachusetts. Instead, insurance payers “cover” such lifesaving medications as is required by law, but only if the provider writes a prescription and the patient then goes to a pharmacy to get it. In guidance that MHA created in 2019 after convening experts on the issue, the best practice recommendation was to place Narcan and other such medications directly in patients’ hands as they leave the emergency department.

H.1337, An Act Relative to Opioid Use Disorder Treatment and Rehabilitation Coverage, sponsored by Reps. Andy Vargas (D-Haverhill) and Kate Donaghue (D-Westborough) would resolve the issue by requiring commercial insurers, MassHealth, and the Group Insurance Commission to not only cover these lifesaving medications but also to reimburse for them when they are dispensed directly to patients. The bill had a hearing before the Joint Committee on Financial Services last week.

“The legislation eliminates common barriers to treatment by deeming medications for opioid use disorder [MOUD] as medically necessary and by prohibiting prior authorization requirements,” said Leigh Simons, MHA’s senior director of healthcare policy. “The bill also removes financial barriers for patients by prohibiting out-of-pocket costs, including co-payments, deductibles, and co-insurance so that cost never prevents someone from accessing addiction treatment and the services they need. Expanding access to these medications not only saves lives but also reduces emergency room visits, hospitalizations, and other high-cost interventions associated with untreated opioid use disorder.”

HPC: Hospital at Home Holds Promise

Hospital at home programs – whereby hospitals provide acute care in a patient’s home rather than in a traditional inpatient hospital setting – have been on the rise in Massachusetts and show promise, but still comprise a very small share of (0.6%) of total hospital inpatient discharges. That’s one of the conclusions of a policy brief that the Health Policy Commission (HPC) released last week.

Hospital at Home in Massachusetts: Trends in an Emerging Clinical Model reports that Massachusetts has eight active hospital at home programs, and that 20 total hospitals have been approved for an Acute Hospital Care at Home waiver from CMS. Medicare’s continued participation in hospital at home programs depends in large part on the extension of flexibilities that are set to expire on September 30 (see story above). In 2024, Medicare patients accounted for two-thirds of all hospital-at-home discharges in the state, according to the HPC.

The HPC found that hospital at home use increased tenfold from 2020 to 2024, and that programs had evolved from primarily ancillary services to more complex patient care in that time. Charges for hospital at home “were roughly the same” as traditional inpatient care by 2024 and hospital at home patients were “far less likely” to be discharged to skilled nursing facilities compared to those being discharged from within hospitals (0.8% vs 11%). At home patients are also “far more likely” to be discharged to home health (40% vs 25%). Further study is needed, the HPC said, to determine how well at home care is reducing emergency room overcrowding and discharge delays; if hospital at home can lower post-acute care use and lower readmission rates, such programs could result in lower healthcare spending over an entire episode of care.

“Hospitals with a high inpatient occupancy rate may have particular operational and financial incentives to expand their acute care capacity through hospital at home,” according to the report. “Operationally, the additional inpatient capacity through hospital at home may help relieve hospitals from ED crowding, discharge delays, and other capacity issues.”

The HPC report follows the July report from the Massachusetts Transitions from Acute Care to Post-Acute Care Task Force, which found that expanding mobile integrated health and hospital at home care models could reduce brick-and-mortar hospital crowding and improve patient throughput.

“Hospital at home is a promising clinical model with benefits for patients who can receive acute care in the comfort of their home, and also potential benefits for the Massachusetts health care system overall,” said HPC Executive Director David Seltz. “Given that nearly two-thirds of patients benefitting from hospital at home in Massachusetts are covered by Medicare, the expiration of Medicare’s authorization for these programs at the end of this month presents a pressing concern.”

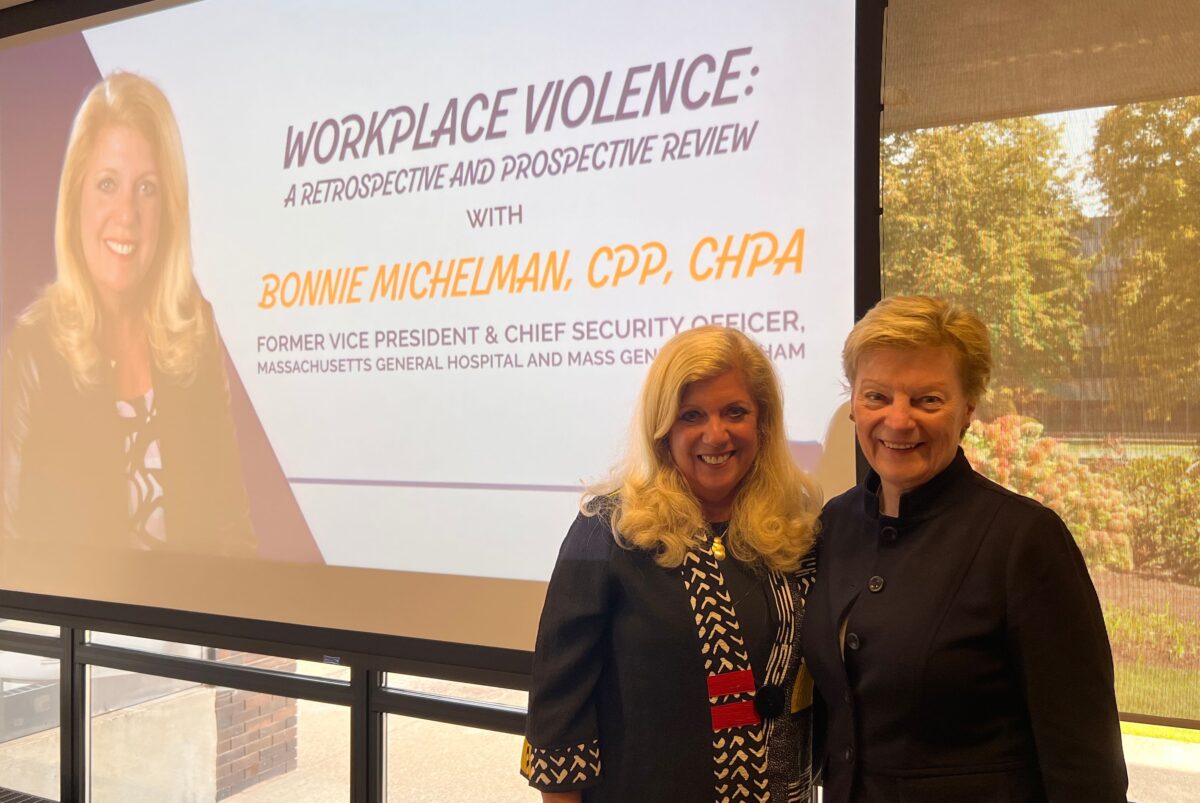

Recognition for a Violence Prevention Champion

More than 150 people attended MHA’s annual Workplace Violence Prevention Summit last Wednesday at MHA’s headquarters in Burlington, Mass.

Attendees were treated to presentations and breakout sessions on the latest best-practice strategies for curbing violence and supporting the healthcare workforce and patients.

A special highlight of the meeting was MHA’s recognition of Bonnie Michelman (left in the photo with MHA’s VP of Clinical Affairs Patricia Noga, R.N.), who recently stepped down from her role as VP and chief security officer at Massachusetts General Hospital and Mass General Brigham. Michelman had long been involved in MHA’s violence prevention efforts and served as chair of the association’s Healthcare Safety & Violence Prevention Workgroup since its founding.

MHA’s efforts in recent years have led to the association’s Board of Trustees unanimously endorsing a United Code of Conduct to protect healthcare workers and patients in their care; joining with labor unions in pressing for passage of H.2655/S.1718, An Act Requiring Health Care Employers to Develop and Implement Programs to Prevent Workplace Violence; issuing guidance on the issue; and holding frequent educational forums, among other initiatives.

Massachusetts Health & Hospital Association

Massachusetts Health & Hospital Association