The Senate Budget, New QIO, Measles, and more…

INSIDE THE ISSUE

> RN Vacancies

> Medicare Advantage Plans

> Market Basket Inflation

> Telehealth Parity

> UMass Memorial Expansion

MONDAY REPORT

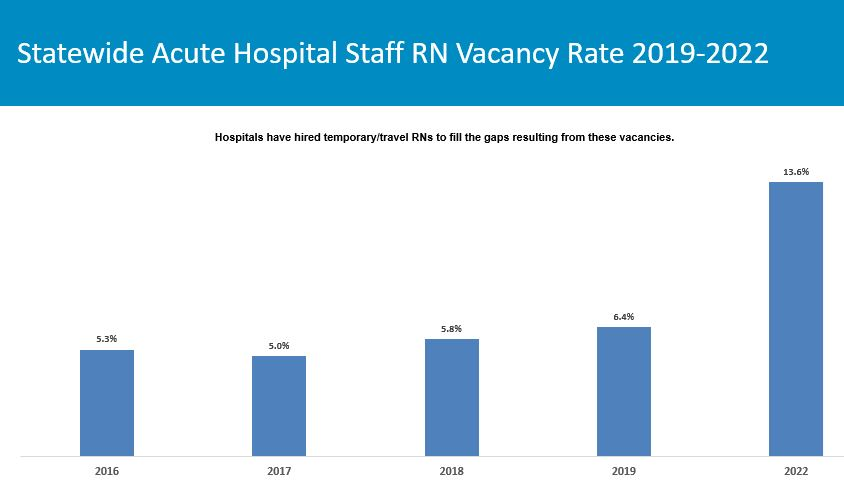

R.N. Vacancies Abound and Temporary Nurse Expenditures Skyrocket

A recent MHA spot survey reveals that more than 5,100 registered nurses (R.N.) would be needed to fill current vacancies at acute care hospitals, and that hospitals already have spent $445 million halfway through Fiscal Year 2022 on temporary nurses to fill the void.

“Hospitals have simply not recovered from the pandemic, which has fundamentally altered operational dynamics at our facilities,” said MHA’s Senior Vice President and General Counsel Mike Sroczynski. “As we have been hearing for many months, the necessary temporary staffing costs are further destabilizing hospital finances.”

According to the MHA survey, temporary staffing costs were $181 million annually at the start of the pandemic in FY2020, ballooned 81% to $328 million through all of FY21, and to date, as of March 31 or halfway through FY22, temporary R.N. staffing costs stand at $445 million. If the current staffing environment holds steady, acute care hospitals could spend nearly $900 million this fiscal year on temporary staffing.

MHA’s spot survey conducted during June 2022 analyzed data from respondent hospitals and extrapolated out for acute care hospitals statewide to determine that currently 5,116 R.N.s would be needed to fill vacancies, distributed between community hospitals (639 vacancies), community high-public-payer hospitals (1,862), specialty hospitals (389), and teaching hospitals (2,226). The statewide staffed R.N. vacancy rate stood at 6.4% in 2019 and has now more than doubled to 13.6% in 2022.

The reasons for the vacancies are multifold, ranging from an aging workforce, burnout from two-plus years of coping with the demands of the pandemic, and the fact that some nurses are leaving staffed positions to take higher-paying jobs with the staffing agencies. Bringing in new R.N.s has always proven difficult for various reasons, including the lack of faculty at schools of nursing. Recruiting nurses to settings like behavioral health – where insurer reimbursement has historically lagged – has proven even more difficult.

MHA has mounted a CEO-level Workforce Task Force that is exploring a variety of solutions including loan forgiveness and tuition reimbursement opportunities, as well as a communications effort to promote the fulfillment that comes from working in healthcare. MHA’s Workforce Summit on July 26 will bring healthcare leaders together to share best practices around recruiting, developing, and retaining healthcare personnel.

“The healthcare workforce is the backbone of our healthcare system, and it is worth every effort we can give to ensure we are supporting and expanding the pool of talented professionals in Massachusetts,” MHA’s Sroczynski said. “While many of these solutions will take time, we continue to urge the legislature to pass the Nurse Licensure Compact bill before the session ends.”

Medicare Advantage Plans Persist With Prior Auth Requirements

Many Medicare Advantage (MA) plans have been inflexible throughout the pandemic, insisting on prior authorizations for routine transfers between hospitals and post-acute facilities, which has in turn caused “direct patient harm,” according to letter MHA sent last week to the regional U.S. Department of Health and Human Services administrator.

Throughout the pandemic, hospitals in Massachusetts and across the country, have battled significant capacity constraints. In Massachusetts, the state’s Medicaid program, MassHealth, waived prior authorization requirements and the Division of Insurance issued numerous directives mandating that commercial insurers do the same. But Medicare Advantage plans are overseen by the federal Centers for Medicare and Medicaid Services; the state has no jurisdiction over their actions.

“As a result, many of the [Medicare Advantage] plans continued to use prior authorization and other utilization management policies that prevented hospitals from using desperately needed health system capacity in post-acute care settings,” MHA’s Senior Vice President & General Counsel Mike Sroczynski wrote to U.S. HHS Regional Administrator Betsy Rosenfeld. These policies were compounded by often inadequate networks and an inability to have peer-to-peer discussions about a particular patient case.

The letter continues: “While throughput issues were significant before the pandemic, COVID-19 has exacerbated the situation and created a large volume of patients who are ready for discharge from hospitals but cannot find an appropriate bed in a post-acute care setting. In some cases, patients who require specialized post-acute care services wait weeks or even months to find an appropriate bed or service. It was no surprise that directors of case management at our hospitals identified private insurance administrative barriers, delayed responses from insurers, and denial of authorization requests to be the most significant challenges to discharging patients to post-acute care settings.”

While MHA and its members have had success addressing the issue with state authorities, Sroczynski noted that state insurance departments do not have authority to intervene in Medicare Advantage plan issues. “We believe strongly that these egregious actions by many MA plans results in delayed care and direct patient harm, and therefore must be escalated and addressed by CMS,” MHA wrote.

Cost of Goods in Market Basket Do Not Reflect Inflation Reality

To set the inpatient payment rate for hospitals treating Medicare patients, the Centers for Medicare & Medicaid Services (CMS) each year releases the Inpatient Prospective Payment System (IPPS) Rule, which bases its payment rate, in part, on the “market basket” costs of goods and services hospitals use.

However, the cost of items in the current market basket does not account for the rising 8-plus-percent inflation rate, meaning that CMS’s Medicare reimbursement to hospitals is inadequate.

“The [FY2023 IPPS] rule’s proposed payment updates and policy changes would result in a net decrease in payments to IPPS hospitals in FY 2023 compared to FY 2022,” the American Hospital Association writes in a fact sheet on the issue. “CMS’ estimates were produced using historical data that in a steady-state economy may predict with some accuracy the anticipated rate of cost increases to determine provider reimbursements. The end of CY 2021 into CY 2022 should not, in any sense, be considered a steady-state economic environment representative of past trends. As a result, the proposed market basket and productivity update will inadequately reimburse hospitals and health systems.”

AHA is urging Congress to compel CMS to use its “special exceptions and adjustments” authority to make a retrospective adjustment to account for the difference between the market basket update that was implemented for FY 2022 and the current projected FY 2022 market basket.

tMED Coalition Makes Final Push for Telehealth Parity, Access

As the healthcare system keeps close track of COVID-19 cases, it is also watching the trend line of influenza activity in Massachusetts. The overall influenza rate in Massachusetts (based on weekly reporting by sentinel provider sites and posted by DPH) is “moderate.” While the most recent week’s data showed more flu cases than the previous three seasons in the same week, the percentage of influenza-associated hospitalizations is comparable to previous seasons.

As the legislative session approaches its end on July 31, the Massachusetts Telemedicine Coalition (tMED), of which MHA is a founding member, wrote the chairs of the Joint Committee on Health Care Financing last week, urging passage of two critical telehealth initiatives.

First, the collection of more than 50 advocates under the tMED umbrella asked Chairs Senator Cindy Friedman (D-Arlington) and Representative John Lawn (D-Watertown) to extend reimbursement parity for primary care and chronic disease management services for two years until December 31, 2024.

Under current state law (Chapter 260 of the Acts of 2020) the state operated under the assumption that primary care services and chronic disease management services would be clearly defined and reimbursed for a period of two years – during calendar years 2021 and 2022. “When Chapter 260 passed, the legislature could not, however, have predicted the course of the COVID-19 pandemic and the subsequent surges related to the delta and omicron variants,” tMED wrote. “Additionally, the Division of Insurance (DOI) did not issue draft regulations until May 2022 and has still not issued final regulations, leaving the definitions for primary care and chronic disease management services undefined 19 months after the law’s effective date. The result has been a lack of predictability and stability in the marketplace for providers, which in turn affects patient access to care. As it currently stands, providers will experience a ‘reimbursement cliff’ as of the end of 2022 where they may no longer receive payment for telehealth on-par with in-person visits.”

The other main priority for the telemedicine advocates is passage of H.1101/S.678, An Act relative to telehealth and digital equity for patients. Among other things the bill would address the “digital divide” that exists, as many communities in Massachusetts struggle accessing telehealth due to affordability and digital fluency. H.1101/S.678 directs the Health Policy Commission to establish two programs – a Digital Bridge Pilot Program and a Digital Health Navigator Tech Literacy Pilot Program – to support expanded access to telehealth technologies and technological literacy.

UMass Memorial Files Expansion Plan With the State

UMass Memorial Health Care has filed a Determination of Need (DoN) application with the Massachusetts Department of Public Health (DPH) seeking a large-scale expansion that will add 91 medical/surgical beds if approved.

UMass Memorial proposes renovating a six-story building adjacent to its University Campus in Worcester to add 72 medical/surgical beds, one computed tomography (CT) unit, and shell space for future clinical services. It also wants to add 19 medical/surgical beds on its Memorial Campus, along with other renovation projects. The proposed project will result in a total of 347 medical/surgical beds in operation at University Campus, 206 medical/surgical beds in operation at Memorial Campus, for a total of 553 medical/surgical beds on the UMass Memorial Medical Center license, and seven CT units across both campuses. The total cost of the project is estimated at $143 million.

In explaining the need for the project, UMass wrote in the DoN: “As a result of the increased demand for inpatient care, the Hospital’s patient panel is experiencing long wait times in the ED as well as high ED boarding rates. Furthermore, due to a lack of available beds, UMMMC is unable to accept a significant number of transfer requests from community hospitals for patients who require more complex care. Additional inpatient capacity is needed to improve ED throughput, provide sufficient access to tertiary care in Central Massachusetts, and to plan for the demands of an aging population.”

Massachusetts Health & Hospital Association

Massachusetts Health & Hospital Association